Rate Review

It is proposed to apply for a rate variation to generate an additional $40 million per year by 2025/26. This will include an increase to the minimum rate for residential and business properties to $990 over 3 years (subject to legislative changes) and a Special Rate Variation (SRV).

Under this proposal, business rating sub-categories will be introduced and the Bankstown CBD Special Rate will be discontinued.

This proposal will address the current rates imbalance and bring about fairness and equity for all ratepayers.

Why is council reviewing the rates system?

The NSW Government requires all merged councils to implement a new aligned rating system by July 1, 2021. This is called harmonisation.

This harmonises minimum rate to $728.18 (residential) and $794.27 (business) in 2021/22. It will also harmonise the rate in the dollar over 5 years.

We also increase the income stream

Council must consider additional options to balance the needs of the community and maintain the financial health and stability of the Council.

Why did Council review its rates?

Your rates provide a range of community services, for the enjoyment, benefit and safety of the whole community.

Rates are the main source of revenue that pay for these services. This contribution, from residential and business ratepayers, is used to maintain community infrastructure.

In addition to paying for all the below services, $70 million every year is needed to keep assets maintained up to current standards.

However, once Council pays for all the services we provide to the community, we only have $39 million left to maintain our assets. This leaves a shortfall of $31 million every year.

Deferring the maintenance and renewal of many assets results in their deterioration.

If you want to know more about this, please read ‘A Funded Future' the 2020 Economic Paper.

How are your rates spent?

Every $100 collected is distributed as follows across a range of services.

Legislation changes

The NSW Government requires all merged councils to implement a new aligned rating system by 1 July, 2021. This is called harmonisation.

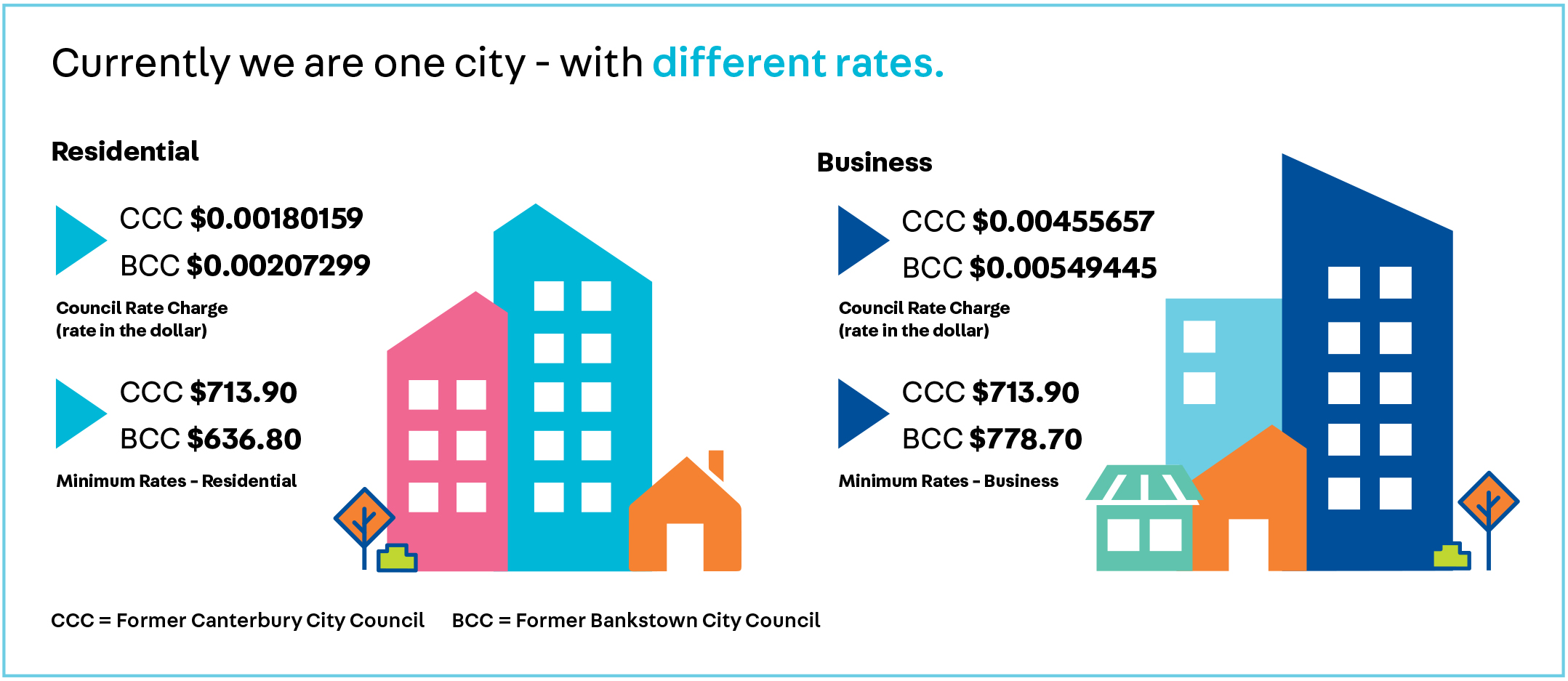

You may not be aware, but currently residential and business ratepayers pay different rates depending on where their property address is located in the City.

As we all share the parks, pools, town centres, roads and footpaths it is only fair that ratepayers contribute equally to the cost of these facilities.

What will Council do with the new rates revenue?

You told us that you want a modern and clean City. This means providing a range of new services and facilities, as well as supporting and investing in our local economy. We want our City and its people to thrive now and in the future. To fund these new services and assets, $40 million per year is needed.

Frequently Asked Questions

All landowners have to pay rates. This includes residential and business property owners.

Your rates fund a range of services and facilities for the community. Rates are the main source of income for councils in NSW.

Your rates are based on the value of your land, not on the value of any dwellings or improvements on it. Your land value is set by the NSW Government.

Ratepayers with land valued under a certain amount are classified as ‘minimum rate payers’ and will pay a set amount for their rates. This ensures the gap between what units (for example) and houses pay for the same Council services is not too large. For those ratepayers above the minimum rate, your rate is determined by a ‘rate in the dollar’ multiplied by your land value.

Yes, rates will change as of 1 July 2021. Rates change every year with the annual IPART CPI increase, and every three years when the Valuer General reviews land values.

This year amalgamated councils are required to ‘harmonise’ their rate structure, so this means a more fair and equitable rating system.

IPART has approved Council’s application to apply a Special Variation (in addition to the annual IPART CPI increase), increasing the rate in the dollar you pay and the minimum rate for residential and business ratepayers.

These changes are essential to securing Council’s financial stability and sustainability to ensure generations to come are well placed to both benefit and enjoy living in Canterbury-Bankstown.

The NSW Government has legislated that all amalgamated Councils, including Canterbury-Bankstown, must ‘harmonise’ their rates as of 1 July 2021. As a result, Council will implement a fair and equitable rates payment structure across the entire local government area.

Harmonisation is just another word for making the rating structure equal or aligned across the City. So, if your residential land is valued by the NSW Government at $400,000 you will pay the same rates no matter where you live in the City. And if your residential land is valued at $400,000 you would be paying less overall than a person living on a property with residential land valued at $1 million. The same applies for business properties.

If a Council wants to apply for a larger increase in rates than the annual IPART CPI increase they need to apply to the NSW Government for a Special Variation (SV). This needs to demonstrate not only the need but that the community has been informed of the proposal. Amalgamated councils have been restricted for applying for SV increases until July 2021, no matter what financial position they were in. This year, Council has applied for, and received approval for, a Special Variation.

YES, residents who hold a pensioner concession card are still entitled to apply for a rate reduction.

Minimum rates are a specific rate, where a minimum amount is levied on each parcel of land, regardless of the land value. This mostly applies to apartments and units, as these dwellings share the land value of the land on which the apartments are built. As a result, they tend to pay substantially lower rates to that of houses. Councils set minimum rates to reduce the gap between what houses and apartments pay in their Local Government Areas. This is because all residents, whether they live in apartments or houses, use Council services like waste collection and local roads.

Just like your cost of living at home, or in your business, costs go up over time. The cost of electricity, goods and services all increase over time. If Council is to continue to provide the services you expect then rates need to increase to keep pace with these rising costs.

Council has a large number of assets and facilities to maintain. These include roads, parks, buildings, sporting fields, footpaths, bushland, stormwater drains etc. New money will go towards the maintenance and upkeep of these assets.

In addition, new money will go towards improving our facilities and services across the city such as revitalising our town centres, upgrading our aquatic facilities, more cleaning programs and creating more public spaces and family friendly areas.

If you are experiencing hardship and receiving Australian Government payments, you may be eligible for a rates deferral or payment arrangement.

Through sensible budget management and service changes, CBCity has already recouped $7.6 million in efficiencies every year since amalgamation. At 305:1, or one staff member for every 305 residents, Council’s ratio of staff to population is the second lowest of all Sydney metropolitan councils. This contributes to CBCity’s low operating costs, which at around $800 per resident, is the fifth lowest operating cost of the metropolitan councils.

Council is committed to continuing our improvement program to identify ways to lower costs, market test services and review the capacity of current assets to deliver desired outcomes.

Council provides a domestic waste collection service. A charge for this service, Domestic Waste Management, is shown on your notice. Council may also levy an annual charge for any services prescribed by State Government Regulations, for example Stormwater Management and interest on overdue rates.

The Independent Pricing and Regulatory Tribunal (IPART) is an independent authority that regulates pricing for water, public transport, electricity, gas and local government. IPART sets the maximum percentage amount by which NSW councils can increase their rate income each year.

You can do this by visiting cb.city/OneRate or you can speak to us, call, write or email at the following:

Mail: PO Box 8, Bankstown NSW 1885

The former Canterbury Council had two SRVs in place – one (an Infrastructure Renewal Levy) that was added to the rate income for a number of years (a temporary rate increase) and another that remains permanently in the rate income.

Council’s all across NSW are struggling with how to increase income and keep costs down. In 2018-2019 CBCity’s ranked 44th in NSW, or 19th in the Sydney Metropolitan region, for the average annual resident rate cost.